Save taxes with a hotel as a second home - company car taxable for dual household management

Save taxes with a hotel subscription*

Use a hotel as a second home and save tax on your company car

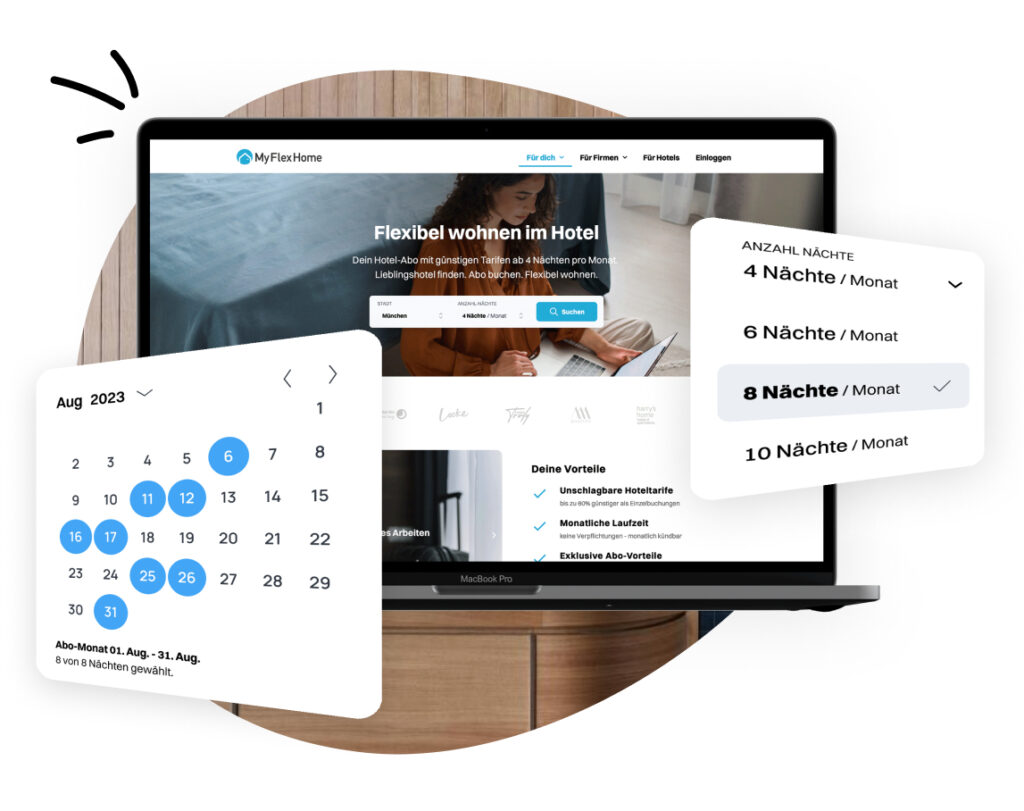

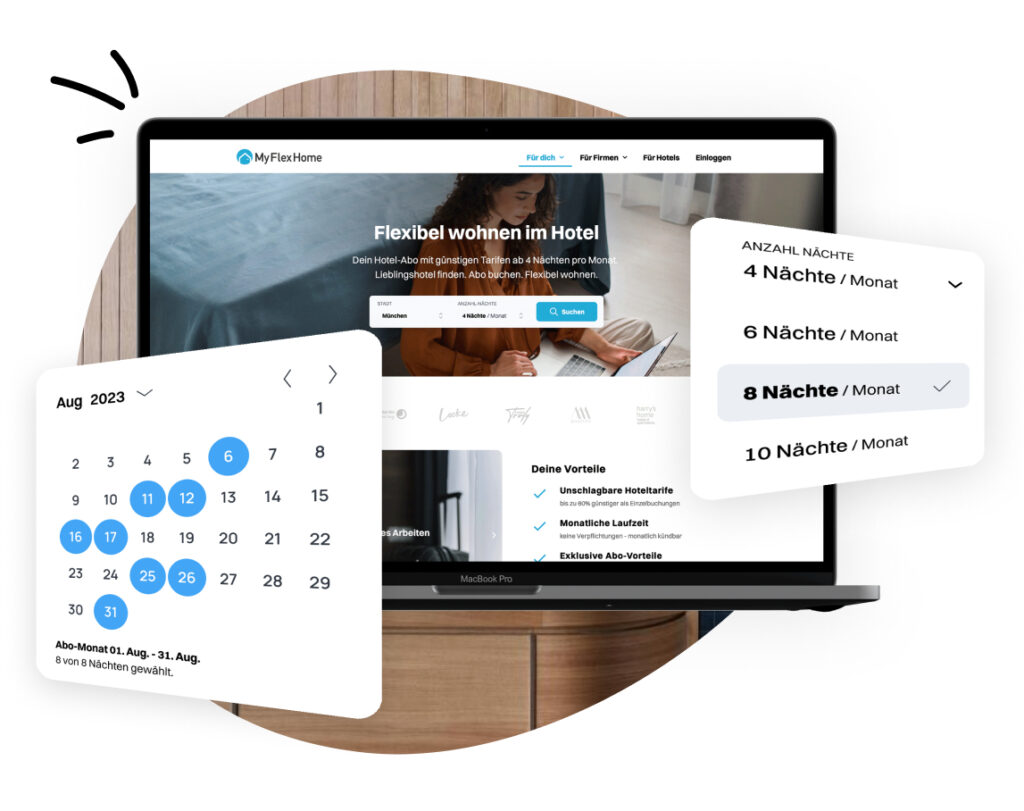

Flexible secondary accommodation

No long rental contracts thanks to flexible hotel subscription term - can be terminated monthly

Simplification of the tax return*

For the MyFlexHome hotel subscription, you receive an annual overview of all nights booked, which significantly simplifies your tax return