Avoid second home tax

with hotel subscription!

Since 01.01.2022, the city of Munich has increased the second home tax from 9% to 18% percent.

Through hybrid work models with 2-3 days home office,

it is worthwhile for many second home no longer worthwhile, since it is empty most of the time.

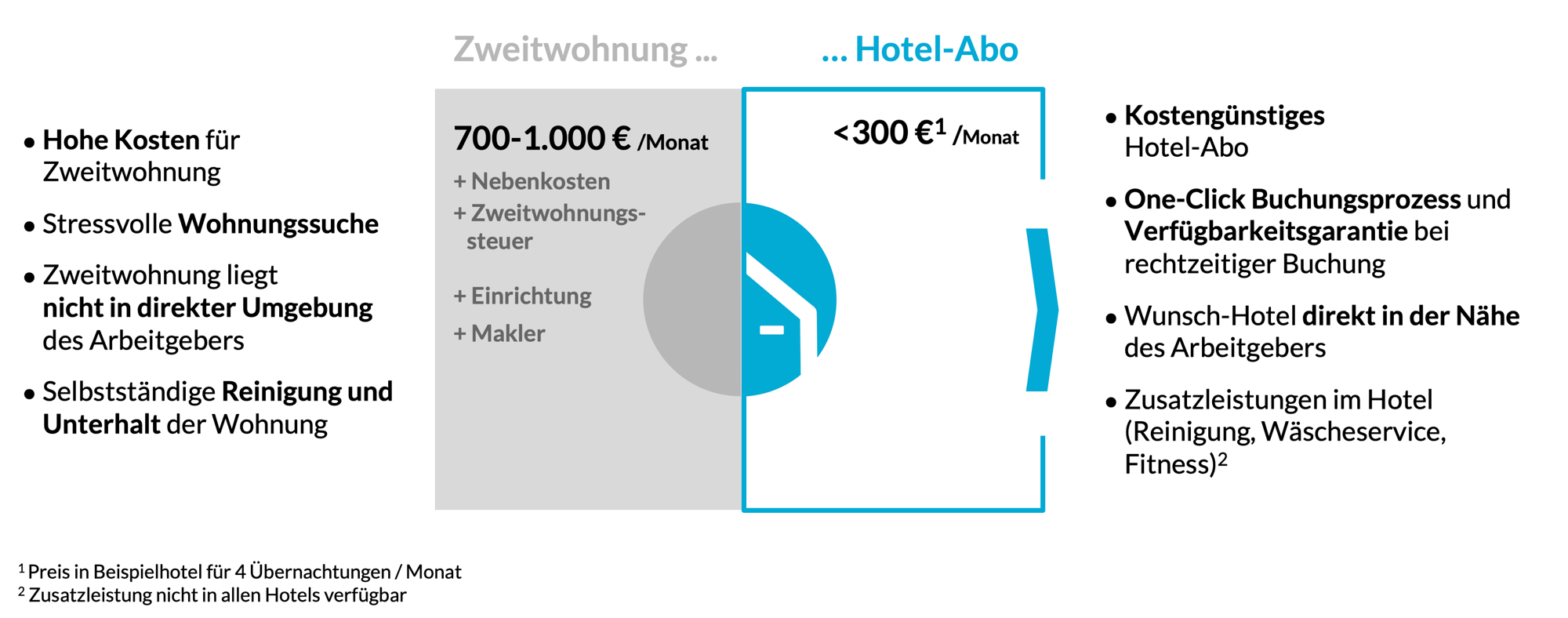

For the days at the site is a hotel subscription the alternative to a second home.

How to avoid the second home tax?

How to save on second home tax? Make a hotel your home in the city. MyFlexHome’s hotel subscription allows you to book the days you need at the hotel at a constant monthly price. Compared to a second home, only a fraction of the costs arise, depending on whether a 4, 6 or 8-night subscription is booked.The second home tax can be avoided or saved by a hotel subscription. You don’t pay a second home tax of 18% in Munich and avoid it with a legal tax trick.By avoiding the tax you can save yourself a lot of money every year. In addition, the subscription costs, as with a second home, can be deducted from tax be

Temporary living with a hotel subscription from MyFlexHome.

At a constant price, you can sleep cheaply for 4 to 12 nights per month in a hotel of your choice and enjoy additional benefits. MyFlexHome offers the solution for your recurring overnight stays with the hotel subscription, no matter if you regularly travel to the same city for business or need to stay overnight for another reason.

© 2025 MyFlexHome